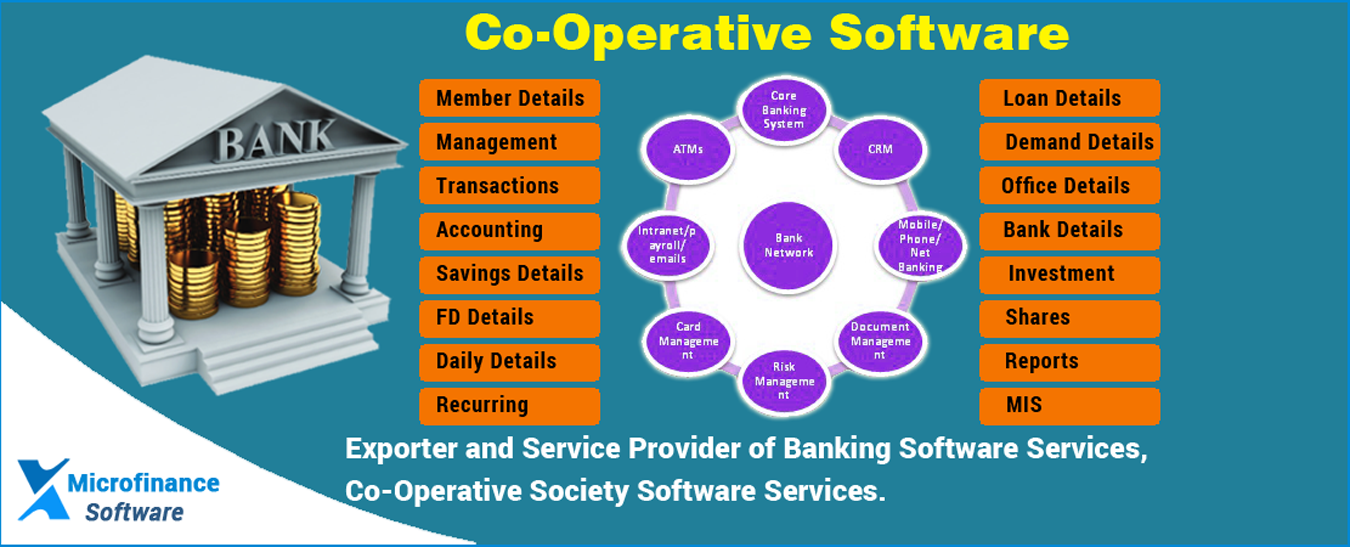

Banking Software Details

Congratulations and welcome to Websoftex Microfinance Banking the finest and customized software tool for managing your Co-operative Society of any type. Easy Banking is a powerful GUI based application designed to take care of all aspects of your societies business with utmost care. The highlight of this software is in its comprehensiveness and the simplicity with which it handles

Complex Tasks with Ease SAILENT FEATURES:

- 1.Can run on various platform Viz. Windows 7x / Windows XP/ Server2010

- 2.Multi-user on windows network.

- 3.Extremely Functional and user friendly with user drivers operation.

- 4.Attractive and well said reports format.

- 5.Report export facility to various useful formats such as Ms Word. Ms excels. Customized and user defined reports.

- 6.Ace reports can be viewed on the screen and can be printed on printer.

- 7.Created by a team of highly experience programmers using the latest software tools with domain knowledge of highly experienced banking professionals and with a feed back of over 25 Co-operative Societies.

- 8.Optimized for best performance on Pentium Pc's Reduces cumbersome and routine work Minimizes errors

Better Control

Multi user version Total satisfaction of customers

Total satisfaction of customers

Efficient M.S system HIGH LIGHTS : -

- 1.Detailed software package drawn up after through study of requirements. Functional and User friendly menus with password protection.

- 2.Provides for multi-level organizational structure wherein different users will have different access levels.

- 3.State-of-the-art- product, which can be customized as per requirements of the society. Carries a warranty of six months from the date of installation. Training of your staff in the usage of the software package. Already installed successful in many

Co-Operative Societies:

- 1. Kannada version of software can also be provided. Drilldown facility.

- 2. Customizable reports.

Cost of Funds & yield on advances:

- 1.Asset, liability & Indirect details of each member.

- 2.Get account information’s; pass sheet, member detail, photo & signature on touch of a button Bank reconciliation.

Easy Banking has been developed to provide the following important features:

- 1. Modular design with proper integration to ensure trouble-free operations without undue complications.

- 2. Optimum security of operations which is very essential for financial transactions

- 3. Comprehensiveness in coverage - a feature absolutely necessary to meet all requirements

- 4. User-friendliness which ensures hassle free usage

- 5. High flexibility with expandability and upgradability. The software can be used by all societies and can be easily upgraded/expanded to cover more activities whenever required.

- 6. The software is capable of handling huge volumes of transactions without any difficulty.

- 7. State of the art technology has been used.

- 8. Control over operations with in-built checks and balances, authorization procedures, etc.

- 9. Elimination of scope for tampering of data

- 10. The system is designed to work for network environment to access the information & update the data by different users simultaneously

Modules included in our Easy Banking Software:

Each module has been designed to cover a wide range of activities. Apart from comprehensive master details each module covers all transactions chronologically and systematically. A bird's eye view of the coverage of the modules is presented below.

1. Membership Management:

Enables customer to enroll as Member, Non-Member, Associate Member and Nominal Member and it consists of Enrollment, member assets And liability details:

- 1. Member Profiles Queries (Share Deposits Loans of the member).

- 2. Photos & signatures of members are stores in data base are accessible when ever required

- 3. Closing of Membership

- 4. Member Address lists

- 5. Reports

2. Share Accounting:

It enables issue of shares, withdrawal of shares, dividend calculation and posting, consolidate dividend report and share register, any time.

- 1) Issuing of shares

- 2) Issuing of additional shares

- 3) Dividend calculation and payment

- 4) Withdrawal of shares

- 5) Share Register.

- 6) Report

3. Operational Accounts:It consists of SB

- a) Account opening.

- b) Transactions (credit/Withdrawal by cash)

- c) Transfers (transfer to/from S.B. Accounts)

- d) Transaction maintenance taking care of minimum balance in account

- e) Interest calculation & postingSchedule

- f) Execution of standing instructions

- g) Photo & Signature of the member available and accessible at the time of each withdrawal transaction for verification

- h) Pass sheet printing.

- i) Account closing.

- j) Reports

4. TermDeposits: Consists of

- a. FD, RD, RICC, Cash Certificate, Pigmy and Thrifts deposits

- b. Account opening

- c. Deposit Receipt printing

- d. Interest calculation and posting

- e. Closing before maturity (Pre Closure)

- f. Closing on maturity

- g. Transfer of Term Deposit Interest to SB,RD

- h. Deposits Renewals

- i. Reports

- j. Deposit Maturity Report.

- k. Interest Provisions

5. Loans and Advances:

Consists of Surety Loan (Unsecured), Crop Loan, Vehicle Loan, Gold Loan, Loan against Deposit (like, FD, RICC / CC) Loan Ledgers &Various types of reports

- 1.Loan sanctioning

- 2.Loan disbursement

- 3.Creation Loan Parameters by user.

- 4.Borrower and Surety Details

- 5.Interest calculation and posting as per the loan schemes.

- 6.Interest Provisions for annual financial year.

- 7.Transfer entries from SB, Shares and Dividend are possible.

- 8.Loan repayment

- 9.Loan Charges posting

- 10.Loan closure

- 11.Penalty Interest

- 12.Loan Ledger view

- 13.Loan Schedule for Different Amount, ROI, Periods.

Reports

- a. Loan Balance pass sheet.

- b. Monthly Demand collection Balance report

- c. Overdue report

- d. NPA report

6. Standing Instructions:

Carrying out of Standing Instruction on day-to-day basis and monitoring of Standing Instruction, cancellation, etc.

- 1) Define Standing Instruction.

- 2) Processing and posting.

- 3) Status of Standing Instruction

- 4) Report

7. Cash-Transaction

Internally updating daybook entries like Receipts, Payments, and Transfers between accounts can be updated internally through the respective modules, direct voucher entries to the G/L are possible

- 1) Receipts and Payments

- 2) Cashier Scroll.

- 3) Cash Register

- 4) Bank reconciliation

8. Daybook and Trial Balance:

- 1) Subsidiary daybook;

- 2) Cash transfer in respect of each account head with abstract no. of vouchers

- 3) Day Book

- 4) Trial Balance

- 5) Subsidiary day book

9. General Ledger & Financial Statements:

Contains summary of transaction in each head of account for a given period and it always

- 1. tallies with Balance Sheet figures

- 2. Pass sheet printing.

- 3. General Ledger.

- 4. Receipt and Payment account.

- 5. Profit and Loss account

- 6. Balance Sheet

10. M.I.S:

Enables management to take quicker and effective online decisions.

- 1.New Members enrolled.

- 2.Memberships closed.

- 3.New Shares issued.

- 4.Shares surrendered.

- 5.List of Members and Associate Members

- 6.Dividend released.

- 7.Member/Non-Member profile

- 8.Savings Bank Accounts opened.

- 9.Savings Bank Accounts closed.

- 10.Savings Bank Accounts list with details.

- 11.Account-wise interest paid on Savings Bank Deposits.

- 12.Term Deposits (FD, RD, Cash certificates) opened and closed.

- 13.Interest paid on Term Deposits.

- 14.Term Deposits due for maturity during any specified period.

- 15.RD Accounts with installment overdue.

- 16.Term Deposits renewed.

- 17.Loan Accounts opened.

- 18.Loan Accounts closed.

- 19.Interest collected on Loan Accounts.

- 20.Loan Installment overdue

- 21.Balance Sheet

- 22.Income and Expenditure

- 23.Indirect liability of a member

- 24.Cost of funds.

- 25.Yield on advances.

- 26.Customizable Reports

- 27.Drill down facility.

- 28.Assets and liability of a member

11. System Administration:

Administration of entire computerized environment includes User Management, Password Management, Day-End, Day-Begin and back-up activities.

- 1.User creation

- 2.Roll creation.

- 3.Day-End

- 4.Day - Begin.

- 5.Back- up & restore.

- 6.Change of Password

12. Initialization and configuration:

- 1.Calendar

- 2.Define GL Account.

- 3.Define GL Group.

- 4.Share parameter.

- 5.Loan parameter

- 6.Deposit slab and parameter.

Banking Software Project Schedule:

- 1. System steady at your place for identifying your requirements.

- 2. We offer our comments/ suggestions on finding of our study by documenting the same and submit for your approval.

- 3. Correct and complete data as on a mutually determined cut off date shall be prepared by the society as per formats given by us and entered to computer. This data is migrated to data base.

- 4. Installation at your premises when customization and testing of software is complete. There after live entries shall be carried out, simultaneously training the staff in using the software. Easy Banking is a totally menu driven software with windows standard pull down style operation.

- 5. The menu consists of main items arranged vertically in alphabetical order. You can access these items by clicking over flat button once you click on any one of the main item, a sub menu drops under it for further selection. A -> symbol on the edge on any item on the sub menu indicates that there exists yet another sub menu under this item for further selection.Reports can be generated in: ENGLISH.

What is meant By Banking Software?

Banking software is project software that is utilized by the saving money industry, regularly keeping money programming points to Core Banking Software and its interfaces that permit business banks to associate with other secluded programming and to the interbank systems.

Why Banking Software's?

Keeping money, contract and monetary administrations ventures handle a lot of delicate budgetary information for their clients consistently. To help oversee and comprehend these numbers, monetary administrations industry banking software’s gives extra security and levels of precision and dependability past what most banking software frameworks offer.

Other than standard records payable (AP) and records receivable (AR) usefulness, money related banking software’s conveys powerful charging, store, and client relationship administration (CRM) abilities.

These frameworks can likewise coordinate with saving money and protection frameworks, bolster accumulations for past due records and that's just the beginning.

Microfinance Banking Software Includes:

- 1.Core Banking

- 2.Client bunches

- 3.Products

- 4.Advances and accumulations

- 5.Announcing

- 6.Confirmation

- 7.Channels

- 8.Examination

Banking and Financial Solutions Software:

Financial Solution Software for the budgetary area computerizes the dullest and blunder inclined errands, which thus expands precision, productivity and general client encounter. Similarly as with any product buy, you'll need to assess what you presently claim, and after that consider your particular needs, for example, charging, client relationship administration, number of clients and particular components offered by the program.

Included Solutions in Banking and Finance

Account Opening

The Microfinance Software for Account Opening, Customer On-boarding and Account Maintenance offers the ideal devices to draw in clients better, quicken business volumes and cut down client procurement costs.

Online Account Opening

Microfinance Software Online Software gives powerful and natural web structures to clients for intelligent on boarding background with a consistent stream of data from outsider frameworks.

Credit Origination

Microfinance Software exhaustively deals with the retail advance lifecycle for an undertaking, diminishing advance start process durations, encouraging sound credit choices and enhancing advance documentation.

Contract

Offers a shrewd Mortgage loaning arrangement that directs a quick, precise Mortgage handle. The Solution guarantees adherence to administrative and consistence necessities.

Exchange Finance

Microfinance Software forms for Banks. Exchanges are all around represented and standards based, streamlining the record and process centricity of the capacity.

Business Lending

The Microfinance Software is a special market software, with Solution Accelerators which change each progression inside the loaning lifecycle.

Installments Solutions

Microfinance Software System is a gathering of brilliant e-installments devices, for example, Check Truncation System (CTS), National Automated Clearing House (NACH), Direct Debit Solution (DDS), Signature Management System (SMS), Post Dated Check Management System (PDCMS), SWIFT and Cheque Flow Lite

Features of Banking or Core Banking Software

- 1.Making and adjusting credits.

- 2.Opening new records.

- 3.Preparing money stores and withdrawals

- 4.Preparing installments and checks

- 5.Figuring interest

- 6.Client relationship administration (CRM) exercises.

- 7.Overseeing client accounts.

- 8.Setting up criteria for least adjusts, loan fees, number of withdrawals permitted et cetera.

- 9.Building up financing costs

- 10.Keeping up records for all the bank's exchanges

Bank Document Management Software

Bank document software, for example micro finance software, wipes out the need to deal with numerous tickler and imaging store frameworks.

Likewise, archive administration frameworks alleviate the need to oversee most paper bank documents. Micro finance software credit archive administration programming can set up the different normal exemptions and parameters naturally, through a daily center download alternative.

This incorporates report, specialized, and approach exemptions and additionally the capacity to track advance arrangements.

This level of automation helps your organization lessen consistence issues and increment profitability. With the saving money archive administration programming from Micro finance software, overseeing credit documents is less demanding than any time in recent memory.

Banking and Microfinance in India:

Indian financial software’s are making waves over the globe. Indian firms giving such answers for banks, budgetary organizations and insurance agencies are seeing a noteworthy increment in their number of clients.

Worldwide banks are constantly underweight to meet the difficulties confronted by quickly changing client requests and rivalry.

Indian arrangements suppliers not just see profoundly the saving money business in various nations, additionally attempt to use such information to turn out with particular answers for address the business needs of keeping money clients.

Click Here For Online Demo

Real Estate Software

Real Estate Software  Self-Help Group(SHG)

Self-Help Group(SHG)  Daily Collection Software

Daily Collection Software Trust Software

Trust Software