NBFC Software Details

NBFC (Non-Banking Financial Company) is registered under the Company Act 1956 in Goa engaged in the principal business of advances and loans, acquisition of shares/ debentures/ bonds/ stocks/ securities that are issued by the Government or local authority like hire-purchase, nature, insurance business, leasing, chit business but does not involved in any institution or organization whose main business is of industrial, agriculture, purchase or sale activities of any products, goods or providing any construction services of immovable property.

Microfinancesoftware.net Company Provides NBFC Software. Microfinance software is one of the most popular and experienced NBFC Software companies in with around 8+ years of experience in building websites.

NBFC Loan Management software:

Microfinance software is providing a best in class NBFC Loan Management software to manage all the Loan Related operations those are required to run an NBFC (Non Banking financial Company). NBFC is a company and has principal business of receive deposits under the scheme in one lump-sum or installments by way of contributions or in any other manner. Core features of User Friendly NBFC software.

Microfinance Software Company is one of them leading Software Company in India which providing fully customizable software for Non Banking Finance Companies. Our one of core team is fully dedicated and experienced in developing the NBFC software to start such company or institutions. The team is capable to develop customize NBFC Software as per your requirement. The web based NBFC Software is capable to take payment online so you can spread your NBFC business across the world.

Salient Features of NBFC Software:

- 1.Easy NBFC management system

- 2.Penalty/ late fee calculation

- 3.Loan management system

- 4.Easy Installment deposit and many more

- 5.Important Reports for NBFC Software

- 6.Installment Deposited

- 7.Upcoming Due Installment

- 8.Policy Allotment

- 9.Loan Payments

- 10.Monthly Statement

- 11.Agent Commission Statement

- 12.User-Friendly, Powerful & Accurate

- 13.Partial Payment Calculation/Tracking

- 14.Easy Payment Postings

- 15.Charges/Collects Late Fees

- 16.Charges/Collects Miscellaneous Fees

Benefits of NBFC Software:

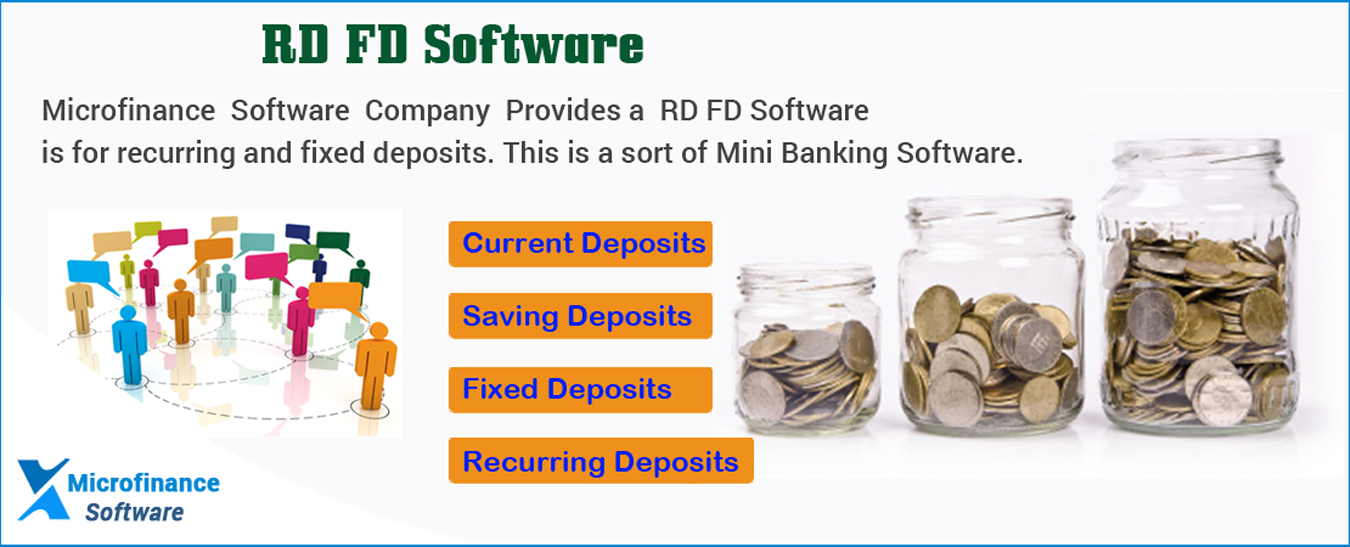

FD, RD and MIS are the three popular long term investment plans and people use to keep their money in these schemes for greater return. With exhaustive knowledge on the core NBFC business, we have designed and developed outstanding off-the-shelf software for NBFC that will help the business to prosper rapidly. Our software is highly efficient to let you manage all your business processes and enhance productivity.

Non-Banking Finance Company Meaning:

What Is Non-Banking Finance Companies?

Non-keeping money monetary organizations, or NBFCs, are budgetary establishments that give certain sorts of managing account administrations, yet don't hold a saving money permit. By and large, these organizations are not permitted to take stores from the general population, which keeps them outside the extent of customary oversight required under managing an account controls.

NBFCs can offer saving money administrations, for example, advances and credit offices, retirement arranging, currency markets, guaranteeing, and merger exercises.

What is difference between banks and NBFCs?

NBFCs are doing capacities much the same as that of banks, however there are a couple of contrasts:

- (i) A NBFC can't acknowledge request stores (request stores are assets saved at a safe organization that are payable on request - quickly or inside a brief period - like your current or investment accounts.)

- (ii) It is not a piece of the installment and settlement framework and in that capacity can't issue checks to its clients; and

- (iii) Store protection office of DICGC is not accessible for NBFC investors not at all like if there should arise an occurrence of banks.

The NBFCs that are enrolled with RBI are:

- 1.Hardware renting organization;

- 2.Procure buy organization;

- 3.Credit organization;

- 4.Speculation organization.

Features of a NBFC:

- 1.The NBFCs are permitted to acknowledge/reestablish open stores for a base time of 12 months and most extreme time of 60 months. They can't acknowledge stores repayable on request.

- 2.NBFCs can't offer financing costs higher than the roof rate endorsed by RBI occasionally. The present roof is 11 for every penny for each annum. The intrigue might be paid or aggravated at rests not shorter than month to month rests.

- 3.NBFCs can't offer blessings/motivators or some other extra advantage to the investors.

- 4.NBFCs (with the exception of certain AFCs) ought to have least venture review FICO assessment.

- 5.The stores with NBFCs are not guaranteed.

- 6.The reimbursement of stores by NBFCs is not ensured by RBI.

- 7.There are sure required revelations about the organization in the Application Form issued by the organization requesting stores.

Importance of NBFC's:

In the present monetary condition it is extremely hard to provide food need of society by Banks alone so part of Non Banking Finance Companies and Micro Finance Companies get to be distinctly imperative.

The part of NBFCs as compelling money related middle people has been very much perceived as they have innate capacity to take faster choices, expect more serious dangers, and alter their administrations and charges additionally as indicated by the requirements of the customers.

Advantages of NBFC's:

- 1.Gives advances and credit offices

- 2.Supporting interests in property

- 3.Exchanging currency advertise instruments

- 4.Financing private schooling

- 5.Riches administration, for example, Managing arrangement of stocks and shares

- 6.Gives retirement arranging

- 7.Exhort organizations in merger and obtaining

- 8.Get ready attainability, market or industry examines for organizations

Disadvantages:

- 1.Less Regulation

- 2.Bring down Lending Standards

- 3.Higher Interest Rates

NBFC Registration and Procedure:

- 1.Prior to the organization to enroll in NBFC, it ought to have enlisted in RBI. The reason is that the directions and operation of NBFC will be according to the RBI Act, 1934. Subsequently, segment 45-IA RBI, 1934 notices that to be a NBFC part, it ought to be an individual from RBI.

- 2.As indicated by RBI Act, NBFC part ought to have a base net of Rs.2 crores.

- 3.To enlist in RBI, the organization ought to fill in the application frame endorsed by the RBI. The organization ought to likewise present all the vital records.

- 4.At the point when the organization fulfills every one of the terms and states of RBI, including the records, it will be issued a declaration. This declaration is called as 'Authentication of Registration'.

- 8.At that point, the NBFC can acknowledge open stores after the ownership of this endorsement.

- 9.NBFCs to acknowledge open stores, they ought to take after every one of the terms and conditions recommended in the Non-Banking Financial Companies Acceptance of Public Deposits Directions, 1998

- 10.To acknowledge or restore open stores, NBFCs least and most extreme periods are 12 and 60 months individually.

- 11.Contributors are not offered any endowments or motivating forces by the NBFCs.

- 12.In the event that there is any reimbursement to be finished by NBFC, the obligation will be taken by NBFC alone. RBI is not subject for such reimbursements.

NBFC Companies Essentials:

A Non-Banking Financial Company (NBFC) is an organization enrolled under the Companies Act, 1956 and is occupied with the matter of credits and advances, obtaining of shares/stock/securities/debentures/securities issued by Government or neighborhood specialist or different securities of like attractive nature, renting, procure buy, protection business, chit business. It does exclude any organization whose foremost business is that of agribusiness movement, mechanical action, deal/buy/development of steadfast property.

A non-managing an account establishment which is an organization and which has its important business of getting stores under any plan or course of action or some other way, or loaning in any way.The stores got don't include speculation, resource financing, or credits. Besides the above class of NBFCs the Residuary Non-Banking Companies are additionally enlisted as NBFC with the Reserve Bank of India.

Rules and Regulations on NBFC Company:

Controls on NBFC:

- A.The NBFCs are permitted to acknowledge/reestablish open stores for a base time of 12 months and greatest time of 60 months. They can't acknowledge stores repayable on request

- B.NBFCs can't offer loan costs higher than the roof rate recommended by RBI every now and then. The present roof is 11 for each penny for every annum. The intrigue might be paid or exacerbated at rests not shorter than month to month rests.

- C.NBFCs can't offer endowments/motivations or whatever other extra advantage to the investors.

- D.NBFCs (with the exception of certain AFCs) ought to have least venture review FICO score.

NBFC Programming Software:

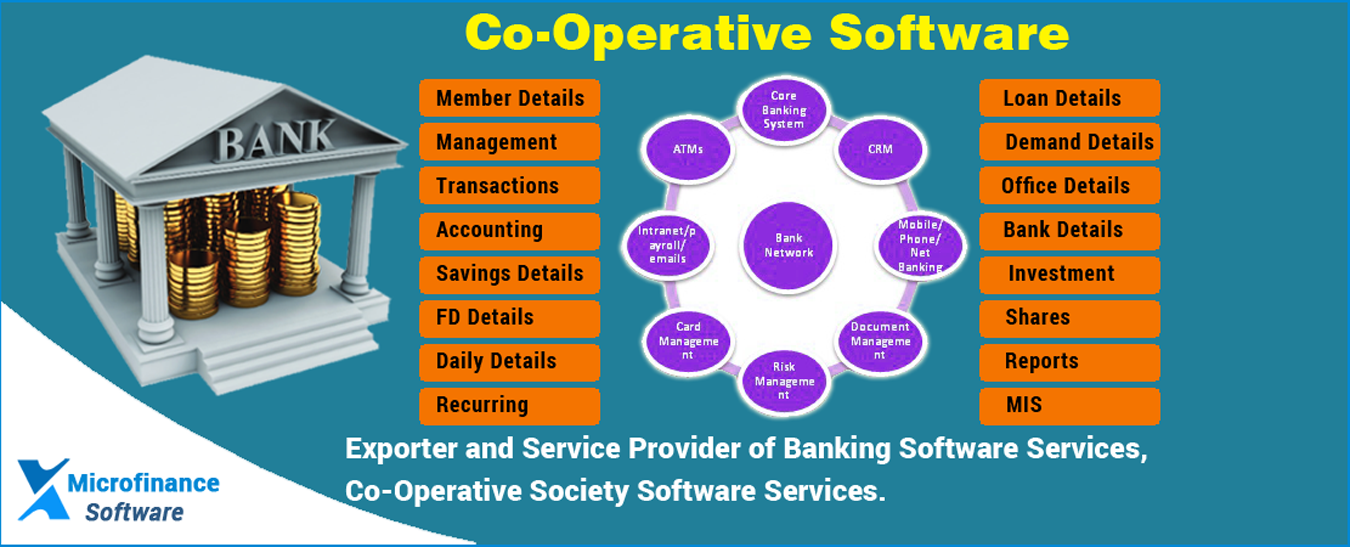

NBFC programming is a streamlined type of saving money programming. It has practically every usefulness that of a keeping money programming.

Features:

- 1.Completely Web based continuous Loan Management Software

- 2.Right symbol Multi-Location, Multi-States, Multi-Branches

- 3.Right symbol Easy To Use Software "Easy to use"

- 4.Right symbol Fabulous Section of Dynamic Settings, Easy and Flawless settings

- 5.Right symbol Complete KYC with confirmation process and documentations

- 6.Right symbol Different - 2 Loan Disbursements sorts like Flat, Reducing, Step Etc.

- 7.Right symbol Auto compute credit sum in light of promised thing's valuation

- 8.Right symbol Calculator Available for Loan settings

- 9.Right symbol Loan portion plan with installment points of interest, late expense, preparing expense, check return charges

- 10.Right symbol Active advance, Reject Loan, Close Loan

- 11Right symbol Set Loan residency Dynamic

- 12.Right symbol Agent Commission Master – Slab creation, Product premise, Amount premise, Target

- 13.Right symbol Loan Foreclosure Settings and Statement

- 14.Right symbol Penalty/late charge computation both sort Available Monthly and Daily

- 15.Right symbol EMI Collection with check/Cash, Emi Collection by PDC

- 16.Right symbol Document Vault for record keeping

- 17.Right symbol Very SimpleF.I. /Verification Process

- 18.Right symbol Charge/Collect Late Fees/Collect Miscellaneous Fees

- 19.Right symbol Fully well versed with SMS and Email Integration

- 20.Right symbol Fully Customizable Solution according to Client's Requirement

- 21.Right symbol Multi sub administrator System to oversee different exercises

- 22.Right symbol Facility of sending out the reports into Microsoft Excel, Word, PDF

- 23.Right symbol Various Type of MIS Report

- 24.Right symbol Dedicated Support Center for Live Query Handling

- 25.Right symbol fully tried with Thousands of Records

- 26.Right symbol more security and straightforwardness

- 27.right symbol Easy To Integrate with any Module if later required by customer

- 28.right symbol Android App Available on Demand

- 29.right symbol POS Machine Collection

- 30.right symbol Recovery Option Available

Non-Banking FAQ:

What is a non-keeping money budgetary organization (NBFC)?

A non-managing an account money related organization (NBFC) is an organization enlisted under the Companies Act, 1956 and is occupied with the matter of credits and advances, procurement of shares/stock/securities/debentures/securities issued by Government or nearby expert or different securities of like attractive nature, renting, employ buy, protection business, chit business yet does exclude any establishment whose essential business is that of horticulture movement, mechanical action, deal/buy/development of resolute property.

A non-managing an account foundation which is an organization and which has its important business of getting stores under any plan or course of action or some other way, or loaning in any way is likewise a non-keeping money budgetary organization (residuary non-saving money organization).

Q2. NBFCs are doing capacities like banks. What is contrast amongst banks and NBFCs?

- 1.NBFCs are doing capacities much the same as that of banks, in any case, there are a couple of contrasts:

- A NBFC can't acknowledge request stores;

- it is not a piece of the installment and settlement framework and in that capacity can't issue checks to its clients; and

- Store protection office of DICC is not accessible for NBFC investors dissimilar to in the event of banks.

Q. 3 Is it important that each NBFC ought to be enrolled with RBI?

As far as area 45-IA of the RBI Act, 1934, it is obligatory that each NBFC ought to be enrolled with RBI to start or carry on any business of non-managing an account money related foundation as characterized in condition (an) of segment 45-I of the RBI Act, 1934.

In any case, to hinder double control, certain class of NBFCs which are managed by different controllers are exempted from the necessity of enlistment with RBI, viz., investment subsidize/dealer keeping money organizations/stock broking organizations enrolled with SEBI, insurance agency holding a legitimate Certificate of Registration issued by IRDA, Nidhi organizations as told under area 620A of the Companies Act, 1956, Chit organizations as characterized in condition (b) of segment 2 of the Chit Funds Act, 1982 or lodging account organizations directed by National Housing Bank.

Benefits of NBFC Software : -

FD, RD and MIS are the three popular long term investment plans and people use to keep their money in these schemes for greater return. With exhaustive knowledge on the core NBFC business, we have designed and developed outstanding off-the-shelf software for NBFC that will help the business to prosper rapidly. Our software is highly efficient to let you manage all your business processes and enhance productivity.

Click Here For Online Demo

Real Estate Software

Real Estate Software  Self-Help Group(SHG)

Self-Help Group(SHG)  Daily Collection Software

Daily Collection Software Trust Software

Trust Software